Master's in Business Administration (MBA)

Program code : Masters in Business Administration (MBA)

Aims

Description

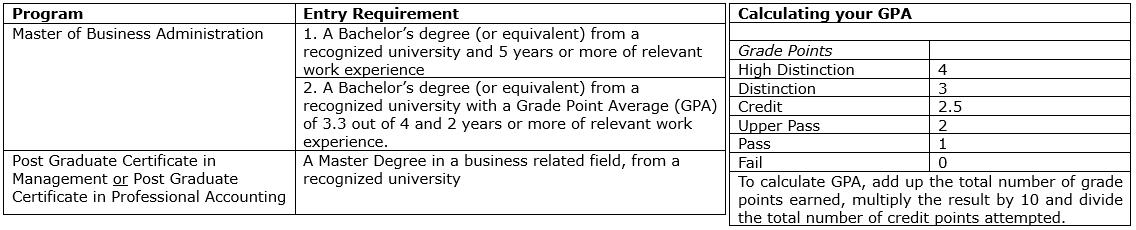

Entry requirement

Thank you for choosing Divine Word University (DWU) to offer you a world class Masters of Business Administration (MBA) program. The DWU MBA program is a program of the Faculty of Business and Informatics offered in collaboration with Macquarie Graduate School of Management of Macquarie University, Australian Catholic University and University of Western Sydney. Divine Word University is renowned for the high quality of its graduates. To maintain these quality standards, the following requirements for entry in to the MBA program are:

Completed Application Form

In order to register for the MBA program, the applicant needs to provide:

- Two completed Referee’s Reports

- Certified copy of Degree Certificate

- Two passport sized ID photographs

- Non-refundable application fee of PGK200 (deposit to Bank South Pacific Account No. 1001129000; attach original of deposit slip to the application form; retain a copy for your records)

The application package needs to be submitted to the Assistant–to-the-Registrar at the Divine Word University campus in Port Moresby.The application package needs to be submitted to the Assistant–to-the-Registrar at the Divine Word University campus in Port Moresby.

Please note: Incomplete or unpaid applications will not be processed.

Duration of study

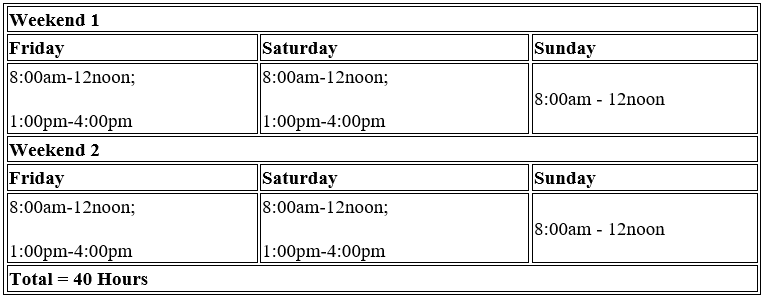

Each year is divided into two semesters. A student is expected to take three units per semester. Each unit is delivered over two weekends. Students may commence the program at the start date of any unit except MB614 for which MB607 and MB610 are pre-requisites. A student who wishes to take more than three units per semester is advised to discuss their plan with the MBA coordinator and obtain approval of the Dean of the Faculty. All 12 units must be completed in order to qualify for the award of MBA.

The units are taught in a 'block' mode. Blocks consist of two weekend periods of fulltime face-to-face lectures followed by 3 – 4 weeks of assignments and exam preparation. The face-to-face lectures will be offered from Friday to Sunday with 20 contact hours per weekend. Attendance during all face-to-face lectures is compulsory. Each unit will be offered once only in a single year. For units in which a final exam is prescribed, the final exam will be held on the third or fourth Saturday following the end of lectures. The MBA coordinator and Assistant-to-the-Registrar maintain open communication with lecturers and students as well as the Dean of the Faculty and University Registrar to provide the best teaching and learning support for the program.

Credit points required

| MBA Program Map | |

| Unit | Credit Points |

| Year 1 | |

| MB639 Ethical Leadership MB607 Accounting Foundations MB618 Business Economics |

15 15 15 |

| MB610 Management Accounting MB615 Organisational Behaviour MB614 Financial Management |

15 15 15 |

| Year 2 | |

| Elective Unit 1 MB617 Business Law Elective Unit 2 |

15 15 15 |

| MB620 Cross Cultural Management Elective Unit 3 Elective Unit 4 |

15 15 15 |

MBA Elective Units

| Management Stream | Accounting and Finance Stream | Entrepreneurship Stream |

| MB649 Quantitative Analysis for Management | MB629 Corporate Accounting | Theory and Practice of Entrepreneurship |

| MB613 Marketing Management | MB630 Accounting Theory | Small Business Management |

| MB619 Human Resource Management | MB631 PNG Taxation and Practice | Creativity & Innovation and Designation Thinking for Entrepreneurs |

| MB621 Strategic Management | MB637 Investment Management | Project Management and Feasibility Analysis |

Units Offered

- Master of Business Administration (Management)

- Master of Business Administration (Accounting and Finance)

- Master of Business Administration (Entrepreneurship)

Master of Business Administration (Management)

Year One - Semester One

MB639 - Ethical Leadership:

The unit explores ethics and philosophy of human acts as foundations of management thought and action. In today’s business many CEOs need to know what the signs are that an organization is getting it right and addressing the most important dimensions of managing ethics, creating ethical culture and an ethical organization. This unit is designed to as assist students to think ethically. Making good business decisions requires a trained sensitivity to ethical issues and a practiced method for exploring the ethical aspects of a decision and weighing the considerations that should impact on the choice of a course of action in any organization. Having a method for ethical decision-making in any organization is absolutely essential in today’s business world. This unit will assist students to create a framework for ethical decision making as a useful process for exploring ethical dilemmas and identifying ethical courses of action in PNG’s complex culturally diverse context. This unit will examine theories of what an ethical community, an ethical business, an ethical government, or an ethical society should be. It will make inquiries into different levels of humans acting ethically as individuals, creating ethical culture and organizations or governments, and making PNG society as a whole ethical in the way it does business and treats everyone.

MB607 - Accounting Foundations:

This unit provides the student with the necessary skills to understand the nature and application of the basic accounting framework and system. All accounting transactions conform to this framework and system. Students are introduced to the concepts and rules governing the identification, measurement, recording and reporting of accounting events and transactions. The application of these transactions in the context of different ownership structures is also examined. On completion of this unit, students will be able to analyse economic events and be able to prepare financial records and reports based on these events. Students will also gain an understanding of the conventions and assumptions associated with the production and use of accounting numbers.

MB618 - Business Economics:

This unit covers basic concepts in economics: demand, supply, elasticity, opportunity costs, comparative advantage, marginal cost and benefit analysis; applications of these concepts to how markets work (and don’t work) and how economic forces are transmitted, especially across borders (forex markets, share markets, property and bond markets etc.); aggregate demand and supply analysis, using basic Keynesian cross, and IS LM models to understand the forces shaping the direction an economy will move in; getting and interpreting current economic statistics; understanding policy issues and the options for dealing with them by, for example, fiscal and monetary tools; and building and using scenarios of the economy for strategic and tactical management purposes at a firm level.

Year One - Semester Two

MB610 - Management Accounting:

The fundamentals of any management accounting system in organisation are to provide appropriate information for the costing of products and services: Support functions – planning, controlling, evaluation, continuous improvement, and decision-making; Competitive support – focuses on the provision of both financial and non-financial services to the management team to enhance the firm’s competitiveness. This unit is designed to provide an understanding of these provisions.

MB615 - Organisation Behaviour:

This unit seeks to engage students with multiple perspectives for understanding and managing their own and others' behaviour within organisations, with a view to developing organisational capability through strengthened internal dynamics. Among the approaches taken are the macro perspectives important in leadership and change, particularly the relationship between behaviour and organisational structure, and psych-social, political and cultural/symbolic aspects of organisations. Other topics covered include individual differences, groups and teams, power, learning, interpersonal communication, perception and ethics.

MB614 - Financial Management:

The fundamentals of financial management are introduced from the perspective of the finance manager in a firm, namely those making investment, financing and dividend decisions. Finance theory is applied with the aim of providing a coherent framework and insights to assist in forming reasoned judgements. Topics include financial decision making – capital budgeting and investment evaluation, valuation of assets, projects and businesses, risk and return, an overview of the local debt and equity markets, capital structure decisions, management of equity and financial risk management. Case studies and financial planning models are used to provide context. The unit covers methods used in evaluating investment projects, and an introduction is given to the local debt and equity markets.

Year Two - Semester One

MB617 - Business Law:

This unit covers principles or requirements of business law that will guide a person who serves in a leadership or managerial role to make decisions that will better serve the interest of his or her organisation. Knowing those principles or requirement include: contract law, company law, trust arrangements, banking law, land related law, tax (including stamp duty) and statutory certifications and approvals. Related topics such as basic anatomy of a commercial transactions and issues involved in transacting with the State and its agencies and instrumentalities will also be covered.

MB613 - Marketing Management (Management Stream Elective):

Marketing as a business discipline involves amongst other things an understanding of the choices of the 'products' and 'markets' within which the firm will operate. Consequently, marketing performs a critical function in the management of modern organisations and in shaping their strategic directions and ultimate profitability. In this sense, "marketing" means more that the popular traditional "managerial" concerns of advertising and personal selling. Furthermore, in recent years, there has developed a growing awareness of the importance of marketing in emerging "non-traditional" areas such as the service, public and non-profit sectors. The influence of new technology, particularly information technology and the Internet is also a potentially important “driver of change” in marketing. These themes, and others, will be explored during the unit. The unit is designed to give a broad overview of the field of marketing. It is intended to provide students with a working knowledge of the various aspects, functions, tools and terminology used by marketers and marketing related stakeholders.

MB619 - Human Resource Management (Management Stream Elective):

Human Resource Management (HRM) explores the policies, practices and processes that are used to manage people in the workplace. It focuses on the way HRM can contribute to increased competitive advantage and to improved short-term performance outcomes, long term sustainability outcomes and to legal compliance outcomes. The unit explores the impact of the changing context in which organisation operate on the way work is organised and managed. It examines a variety of theoretical approaches to managing people and develops in detail the strategic approach to human resources management. Policies involved in attracting and retaining people, improving employee performance, motivating and rewarding job performance and fostering learning and development are examined. Three of the themes running through the unit are that there are things that can be done to improve the way people are managed; that policies and practises need to be consistent; and that the process of policy implementation could result in practice being different to the intention of the policy.

Year Two - Semester Two

MB620 - Cross Cultural Management:

The objective of this unit is to equip students with the knowledge and skills which are necessary for them to interact effectively with members of cultures other than their own, specifically in the context of international business relations. Essentially the unit is concerned with considering the issues and problems of managing in different cultures, in particular, the 'people problems’ that invariably arise in international business relationships.

MB649 - Information and Decision Analysis (Management Stream Elective):

This unit introduces a number of quantitative techniques and models of analysis applicable in any decision-making situation. The range of techniques and models includes statistical analysis techniques and mathematical models. Students develop competencies in articulating a situation that requires a decision to be taken by identifying the parameters involved and defining its mathematical equivalent in the form of a system model. Before a system model can be solved, it will require data input. Students develop competencies in statistical methods of data collection, organisation and analysis as well as interpretation and reporting of the findings from the analysis. The relationship between the data input to a model and information output from the model and how these connect to the decision-making situation under consideration form the core of the unit.

MB621 - Strategic Management (Management Stream Elective):

The purpose of this course is to help you develop your own point of view on the formulation and implementation of corporate strategy and on the roles and tasks of corporate leaders such as general managers. The basic aim is to teach you how to think and act like a business leader responsible for the strategic health of the total enterprise. It should help you work more effectively with or for, or as an advisor to, other leaders within the organisation. This course has a strong focus on case-studies and discourse between theory and practice. This derives from the text, readings, you research, class discussion. In summary, strategic management is designed to help you prepare to become an effective corporate leader. You will be exposed to program definition, situation analysis, priority setting, and action. You will learn more basic guidelines that will lead to outstanding performance. And you will have an opportunity to develop your own views on what style; approaches, attitudes and behaviour (in you and your staff) are likely to lead to success.

Master of Business Administration (Accounting and Finance)

Year One - Semester One

MB639 - Ethical Leadership:

The unit explores ethics and philosophy of human acts as foundations of management thought and action. In today’s business many CEOs need to know what the signs are that an organization is getting it right and addressing the most important dimensions of managing ethics, creating ethical culture and an ethical organization. This unit is designed to as assist students to think ethically. Making good business decisions requires a trained sensitivity to ethical issues and a practiced method for exploring the ethical aspects of a decision and weighing the considerations that should impact on the choice of a course of action in any organization. Having a method for ethical decision-making in any organization is absolutely essential in today’s business world. This unit will assist students to create a framework for ethical decision making as a useful process for exploring ethical dilemmas and identifying ethical courses of action in PNG’s complex culturally diverse context. This unit will examine theories of what an ethical community, an ethical business, an ethical government, or an ethical society should be. It will make inquiries into different levels of humans acting ethically as individuals, creating ethical culture and organizations or governments, and making PNG society as a whole ethical in the way it does business and treats everyone.

MB607 - Accounting Foundations:

This unit provides the student with the necessary skills to understand the nature and application of the basic accounting framework and system. All accounting transactions conform to this framework and system. Students are introduced to the concepts and rules governing the identification, measurement, recording and reporting of accounting events and transactions. The application of these transactions in the context of different ownership structures is also examined. On completion of this unit, students will be able to analyse economic events and be able to prepare financial records and reports based on these events. Students will also gain an understanding of the conventions and assumptions associated with the production and use of accounting numbers.

MB618 - Business Economics:

This unit covers basic concepts in economics: demand, supply, elasticity, opportunity costs, comparative advantage, marginal cost and benefit analysis; applications of these concepts to how markets work (and don’t work) and how economic forces are transmitted, especially across borders (forex markets, share markets, property and bond markets etc.); aggregate demand and supply analysis, using basic Keynesian cross, and IS LM models to understand the forces shaping the direction an economy will move in; getting and interpreting current economic statistics; understanding policy issues and the options for dealing with them by, for example, fiscal and monetary tools; and building and using scenarios of the economy for strategic and tactical management purposes at a firm level.

Year One - Semester Two

MB610 - Management Accounting:

The fundamentals of any management accounting system in organisation are to provide appropriate information for the costing of products and services: Support functions – planning, controlling, evaluation, continuous improvement, and decision-making; Competitive support – focuses on the provision of both financial and non-financial services to the management team to enhance the firm’s competitiveness. This unit is designed to provide an understanding of these provisions.

MB615 - Organisation Behaviour:

This unit seeks to engage students with multiple perspectives for understanding and managing their own and others' behaviour within organisations, with a view to developing organisational capability through strengthened internal dynamics. Among the approaches taken are the macro perspectives important in leadership and change, particularly the relationship between behaviour and organisational structure, and psych-social, political and cultural/symbolic aspects of organisations. Other topics covered include individual differences, groups and teams, power, learning, interpersonal communication, perception and ethics.

MB614 - Financial Management:

The fundamentals of financial management are introduced from the perspective of the finance manager in a firm, namely those making investment, financing and dividend decisions. Finance theory is applied with the aim of providing a coherent framework and insights to assist in forming reasoned judgements. Topics include financial decision making – capital budgeting and investment evaluation, valuation of assets, projects and businesses, risk and return, an overview of the local debt and equity markets, capital structure decisions, management of equity and financial risk management. Case studies and financial planning models are used to provide context. The unit covers methods used in evaluating investment projects, and an introduction is given to the local debt and equity markets.

Year Two - Semester One

MB617 - Business Law:

This unit covers principles or requirements of business law that will guide a person who serves in a leadership or managerial role to make decisions that will better serve the interest of his or her organisation. Knowing those principles or requirement include: contract law, company law, trust arrangements, banking law, land related law, tax (including stamp duty) and statutory certifications and approvals. Related topics such as basic anatomy of a commercial transactions and issues involved in transacting with the State and its agencies and instrumentalities will also be covered.

MB629 - Corporate Accounting (Accounting & Finance Stream Elective):

The goal of this unit is to understand the accounting issues that arise from the various forms of corporate organization and how these translate into disclosure issues for financial reporting purposes. The unit includes company formation and liquidation; accounting for a group of related companies and other associated entities; and modern disclosure practices. The prescriptions for accounting policies under IFRS are examined. It builds on accounting knowledge and business contexts of PNG. It emphasises the critical role of accurate, reliable financial disclosures for advancing the economic prospect of business and government. Corporate governance and audit provisions are also examined.

MB630 - Accounting Theory (Accounting & Finance Stream Elective):

This unit focuses on the methodologies employed in developing accounting policies both in PNG and abroad. It concentrates on how decision makers use accounting information and are involved in its development. Various theoretical and professional approaches which underpin practice are considered. This unit discusses the frameworks which could be applied to financial reporting and assesses the impact such models have had, or could have, on our understanding about the measurement and disclosure issues in financial reporting. This unit focuses on accounting development, historic and prospective. It ties together issues confronting disclosure and reporting practices as well as examining problems emerging regarding governance, accountability and sustaining business entities.

Year Two - Semester Two

MB620 - Cross Cultural Management:

The objective of this unit is to equip students with the knowledge and skills which are necessary for them to interact effectively with members of cultures other than their own, specifically in the context of international business relations. Essentially the unit is concerned with considering the issues and problems of managing in different cultures, in particular, the 'people problems’ that invariably arise in international business relationships.

MB631 - PNG Taxation and Practice (Accounting & Finance Stream Elective):

Taxation law is complex and varied. This unit introduces the various types of PNG taxes and the overall scheme for the application of taxes and then focuses on the key provisions of Income Tax Law including the interrelationship of income tax and business operations. Conditions for applying and complying are reviewed as well as the consequences of taxation policy. Tax and its consequences pervade commercial life and impact most business activity and decision- making. Knowledge of tax effects is critical for all professionals working in PNG.

MB637 - Investment Management (Accounting & Finance Stream Elective):

This unit critically examines the academic and professional literature pertaining to the investment setting, market efficiency, investment objectives, portfolio strategies and risk pricing, valuation of equity, debt and property investments, managed funds, and alternative investments. A value biased view of investing is taken which challenges conventional valuation techniques and approaches. The unit also considers investing from the viewpoint of the individual, as well as from the standard institutional perspective.

| [ ] | 506 kB | |

| [ ] | 105 kB | |

| [ ] | 141 kB | |

| [ ] | 284 kB |